- Top Lines

Last week, Silicon Valley Bank (SVB) collapsed, constituting the largest U.S. bank failure since 2008.

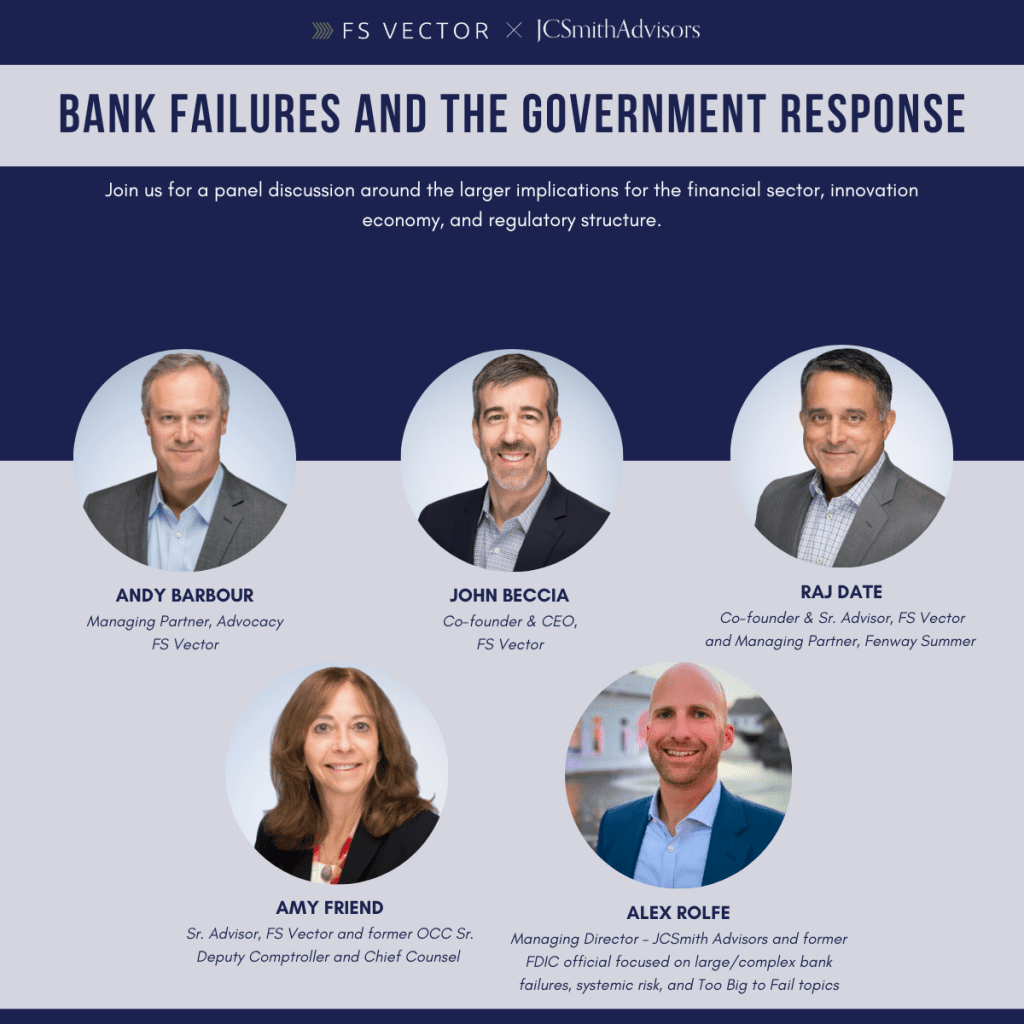

The FS Vector Team and JCSmith Advisors held a webinar series discussing the developing situation as well as the larger implications for the financial sector, innovation economy, and regulatory structure. View the recorded sessions below.

- Part 1, Session 1: Pre-market status updates with former FDIC official, Alex Rolfe

- Part 1, Session 2: Pre-market status updates with former FDIC official, Alex Rolfe

- Part 2: Bank Failures and the Government Response

- More on the SVB Collapse

The White House published a fact sheet stating that President Biden is urging Congressional action to strengthen accountability for senior bank executives. Specifically, the fact sheet states that “when banks fail because of mismanagement and excessive risk taking, it should be easier for regulators to claw back compensation from executives, to impose civil penalties, and to ban executives from working in the banking industry again,” and calls on Congress to “expand the FDIC’s authority to claw back compensation – including gains from stock sales – from executives at failed banks like Silicon Valley Bank and Signature Bank.

In response, House Financial Services Committee Ranking Member Maxine Waters (D-CA) sent a letter to the Fed, the FDIC and the SEC announcing that she is crafting legislation to enhance executive authority around bank failures to better protect depositors, and urging regulators to finish bank compensation rules, and use its available enforcements to hold executives accountable for any unlawful activity.

Senator Elizabeth Warren (D-MA) and Representative Katie Porter (D-CA) led dozens of Democratic lawmakers to introduce the Secure Viable Banking Act, legislation that would repeal Title IV of the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018. The full text of the bill is available here.

Secretary of the Treasury Janet Yellen, Federal Reserve Board Chair Jerome Powell, FDIC Chairman Martin Gruenberg, and Acting Comptroller of the Currency Michael J. Hsu released a joint statement supporting deposits by 11 banks totaling $13 billion into First Republic Bank. “This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system,” they said.

Congressman Tom Emmer (R-MN) sent a letter to the FDIC regarding “reports that the FDIC is weaponizing recent instability in the banking sector to purge legal crypto activity from the U.S.” He says these actions will lead to further instability and calls for nonpartisan solutions for the digital asset community.

We expect Congress to begin scheduling hearings examining the bank failures before the end of the month.

- Weekly Wrap Up

The Justice Department and the Consumer Financial Protection Bureau (CFPB) announced that they filed a statement of interest to explain the application of the Fair Housing Act (FHA) and the Equal Credit Opportunity Act (ECOA) to lenders relying on discriminatory home appraisals. The statement of interest was filed in Connolly, et al. v. Lanham, et al., a lawsuit currently pending in the U.S. District Court for the District of Maryland alleging that an appraiser and a lender violated the FHA and ECOA by lowering the valuation of a home because the owners were Black and by denying a mortgage refinancing application based on that appraisal.

The Federal Reserve announced that the FedNow Service will start operating in July and provided details on preparations for launch. The first week of April, the Federal Reserve will begin the formal certification of participants for launch of the service. Early adopters will complete a customer testing and certification program, informed by feedback from the FedNow Pilot Program, to prepare for sending live transactions through the system.

The CFPB launched an inquiry into the business practices of data brokers. In the Request for Information (RFI), the CFPB seeks “to understand the full scope and breadth of data brokers and their business practices, their impact on the daily lives of consumers, and whether they are all playing by the same rules.” The CFPB stated that the public input will inform planned rulemaking under the Fair Credit Reporting Act (FCRA).

The CFPB published a blog entitled “bringing tech enforcers together to protect consumers.” The blog states that “large-scale technology companies often produce new technologies that want to reshape the consumer financial marketplace to benefit their growth and market share instead of to benefit consumers.” The CFPB will host a training session for government employees in April.

The CFPB published the 2022 Financial Literacy Annual Report, detailing the CFPB’s financial literacy strategy and activities to improve the financial literacy of consumers.

Federal Reserve Governor Michelle Bowman delivered remarks entitled “The Innovation Imperative: Modernizing Traditional Banking”. Bowman discussed new technologies, and stated that “a transparent regulatory posture for these activities can help banks of all sizes embrace new technologies, to the benefit of their customers and the broader economy.” Bowman also said that “until clear statutory and regulatory parameters exist to govern [crypto]assets and the exchanges on which they are traded, I think some of the uncertainties about how the banking system can engage in crypto activities will remain unsettled.”

The Federal Trade Commission launched an inquiry into the small business credit reporting industry, ordering five firms to provide the Commission with detailed information about their products and processes. The orders will be issued to Dun & Bradstreet, Experian Information Solutions, Equifax, Ansonia Credit Data, and Creditsafe USA.

The FTC finalized an order requiring Epic Games, the maker of the Fortnite video game, to pay $245 million to consumers to settle charges that the company used dark patterns to trick players into making unwanted purchases and let children rack up unauthorized charges without parental involvement.

- ICYMI

Federal Reserve Vice Chair for Supervision Michael Barr delivered remarks entitled “Supporting Innovation with Guardrails: The Federal Reserve’s Approach to Supervision and Regulation of Banks’ Crypto-related Activities.” Vice Chair Barr discussed concerns related to crypto, including illicit financing and liquidity and credit risks, and emphasized the importance of balancing innovation with safeguards. Vice Chair Barr also stated that the Board of Governors of the Federal Reserve (FRB) is “working with the other bank regulatory agencies to consider whether and how certain crypto-asset activity can be conducted in a manner that is consistent with safe and sound banking.”