- Top Lines

Congressman Patrick McHenry (R-NC), Chairman of the House Financial Services Committee, and Congresswoman Maxine Waters (D-CA), Ranking Member of the House Financial Services Committee, sent a letter to the U.S. Government Accountability Office (GAO) calling on the Office to begin a study and an investigation into the recent collapse of Silicon Valley Bank and Signature Bank. Specifically, the lawmakers urge the office to examine the factors that led to the mismanagement of both banks, including any regulatory or examination failures.

The Chairman of the House Financial Services Subcommittee on Oversight and Investigations, Bill Huizenga (R-MI), the Chairman of the Subcommittee on Financial Institutions and Monetary Policy, Andy Barr (R-KY), and Congresswoman Young Kim (R-CA) sent a letter to Vice Chair for Supervision of the Board of Governors of the Federal Reserve System (FRB) Michael Barr and President and CEO of the Federal Reserve Bank of San Francisco (FRBSF) Mary Daly expressing concern about supervisory activity conducted prior to the collapse of Silicon Valley Bank (SVB). In the letters, the lawmakers specifically demand all communications between the FRB and FRBSF, along with the regulators’ communications with SVB and SVB Financial Group regarding supervisory determinations and regulatory red flags, among other requests. Read the full letter here.

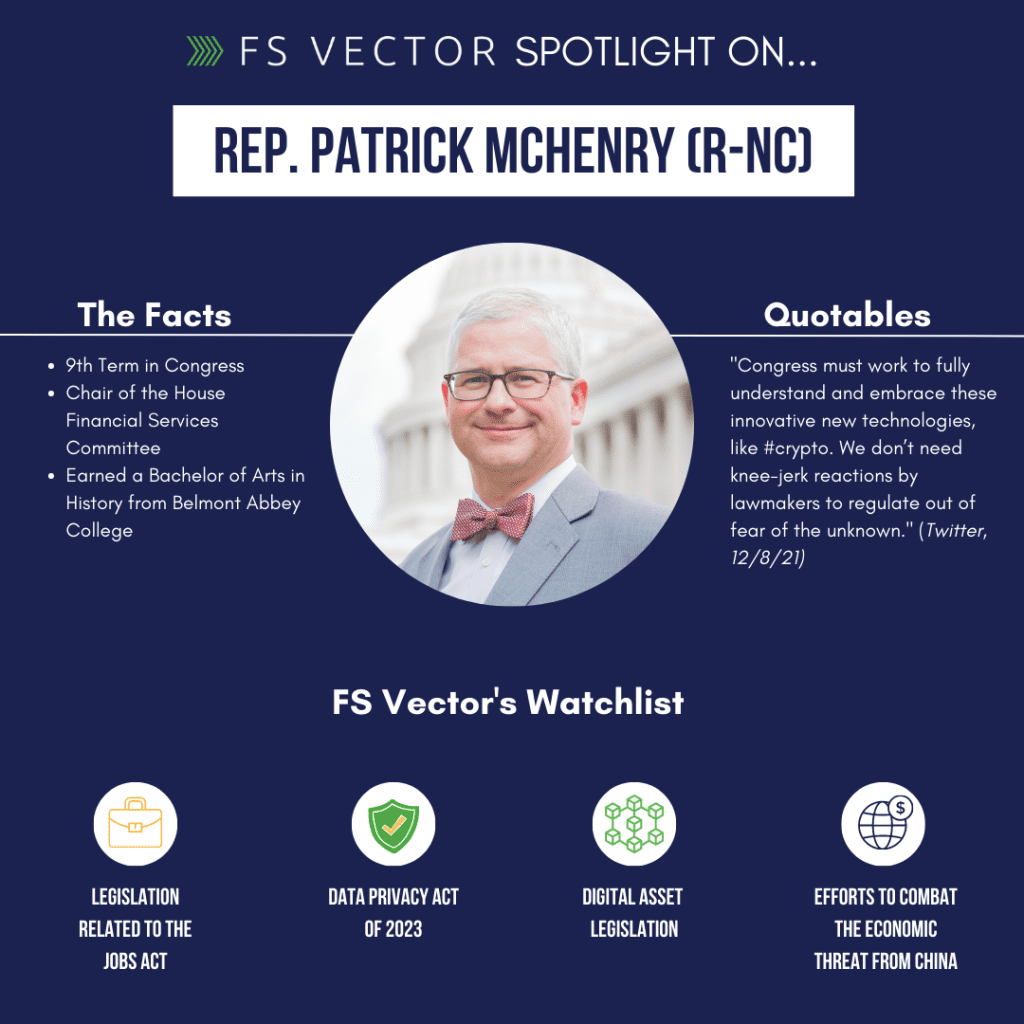

We’re excited to kickoff our Congressional Member Spotlight series with Rep. Patrick McHenry! This is the first in a series where we will be highlighting a member of Congress and fintech-related developments.

- Weekly Wrap Up

The White House released the Economic Report of the President. The report includes a chapter on digital assets and economic principles and raises many issues with the sector, including that “many [cryptocurrencies] do not have fundamental value.” The report further states that though “it has been argued that crypto assets may provide other benefits, such as improving payment systems, increasing financial inclusion and creating mechanisms for the distribution of intellectual property and financial value that bypass intermediaries that extract value from both the provider and recipient,” that “so far crypto assets have brought none of these benefits.” The report also cites recent events involving Terra, BitConnect, and FTX as examples of consumer harm.

The Office of Financial Research (OFR) published a working paper entitled Digital Currency and Banking-Sector Stability, in which the authors model a financial sector where digital currencies coexist with bank deposits and households hold both forms of liquidity. The report concludes that should a digital currency be fully integrated into the financial system, household welfare may improve but banking-sector stability may suffer.

The Securities and Exchange Commission (SEC) issued an investor alert urging investors to “exercise caution with crypto asset securities.” The alert warns that those offering crypto asset investments or services may not be complying with applicable law, including federal securities laws; that investments in crypto asset securities can be exceptionally risky, and are often volatile; that fraudsters continue to exploit the rising popularity of crypto assets to lure retail investors into scams, often leading to devastating losses; and that having an investing plan, as well as understanding risk tolerance and time horizon, can be critical to investing success.

The Treasury Department and the Internal Revenue Service (IRS) announced that they are soliciting feedback for upcoming guidance regarding the tax treatment of a nonfungible token (NFT) as a collectible under tax law. The IRS also describes how the IRS intends to determine whether an NFT is a collectible until further guidance is issued. Comments should be submitted on or before June 19, 2023.

The Consumer Financial Protection Bureau (CFPB) launched an improved survey of credit card issuers that can help consumers and families compare interest rates and other features when shopping for a new credit card.

The SEC announced charges against crypto asset entrepreneur Justin Sun and three of his wholly-owned companies, Tron Foundation Limited, BitTorrent Foundation Ltd., and Rainberry Inc. (formerly BitTorrent), for the unregistered offer and sale of crypto asset securities Tronix (TRX) and BitTorrent (BTT). The SEC also charged Sun and his companies with fraudulently manipulating the secondary market for TRX through extensive wash trading.

The SEC simultaneously also charged eight celebrities for touting TRX and/or BTT without disclosing that they were compensated for doing so and the amount of their compensation: Lindsay Lohan; Jake Paul; DeAndre Cortez Way (Soulja Boy); Austin Mahone; Michele Mason (Kendra Lust); Miles Parks McCollum (Lil Yachty); Shaffer Smith (Ne-Yo); and Aliaune Thiam (Akon).

The U.S. Court of Appeals for the Second Circuit ruled that the CFPB’s independent funding through the Federal Reserve is constitutional ahead of a U.S. Supreme Court case challenging the agency’s funding.

The CFPB took action against Portfolio Recovery Associates, one of the largest debt collectors in the nation, for allegedly violating a 2015 CFPB order and engaging in other violations of law. The CFPB filed a proposed order that, if entered by the court, would require Portfolio Recovery Associates to pay more than $12 million to consumers harmed by its practices, in addition to a $12 million penalty that would be deposited into the CFPB’s victims relief fund.

The OCC announced that it has conditionally approved Flagstar Bank to purchase assets and assume certain liabilities of Signature Bridge Bank. The transaction includes the purchase by Flagstar Bank of certain loan portfolios from Signature Bridge Bank that total $12.9 billion and the assumption of $34 billion in deposits.

The Federal Trade Commission (FTC) announced a Request for Information (RFI) seeking information about the competitive dynamics of cloud computing, the extent to which certain segments of the economy are reliant on cloud service providers, and the security risks associated with the industry’s business practices. In addition to the potential impact on competition and data security, FTC staff are also interested in the impact of cloud computing on specific industries including healthcare, finance, transportation, e-commerce, and defense.

The FTC announced a Notice of Proposed Rulemaking (NPRM) that would require companies to make subscription cancellation easier for customers. The NPRM would also require companies to send a reminder before automatically renewing a subscription.

The Commodity Futures Trading Commission (CFTC) held the inaugural meeting of its Technology Advisory Committee (TAC) under the sponsorship of Commissioner Christy Goldsmith Romero. The TAC discussed decentralized finance (DeFi), cyber resilience in financial markets, and artificial intelligence (AI).

The Senate Finance Committee held a hearing to discuss President Biden’s FY 2024 budget. Additionally, though not originally the purpose of the hearing, the Committee focused heavily on the recent federal response to the failure of both Silicon Valley Bank (SVB) and Signature Bank.

- ICYMI

Silicon Valley Bank (SVB) collapsed, constituting the largest U.S. bank failure since 2008.

The FS Vector Team and JCSmith Advisors held a webinar series discussing the developing situation as well as the larger implications for the financial sector, innovation economy, and regulatory structure. View the recorded sessions below.

- Part 1, Session 1: Pre-market status updates with former FDIC official, Alex Rolfe

Part 1, Session 2: Pre-market status updates with former FDIC official, Alex Rolfe

- Part 2: Bank Failures and the Government Response

The first anniversary of Russia’s invasion of Ukraine saw a dramatic quantitative and qualitative expansion in sanctions against Russia. At the same time, Congress increased its focus on China through a series of committee legislative markups in the House and introduction of bills in the Senate. Read more in our latest Sanctions Watch here.